When clients turn to us for recommendations on which tax system to choose for doing business in Ukraine, we usually provide a list of key criteria that will help them independently determine the most optimal option. And in this article we will share them, in addition:

- find out what tax systems exist for business in Ukraine and describe them;

- let’s explain with an example what you should pay attention to when choosing a taxation system, taking into account the specifics of the business.

Tax systems for business in Ukraine

The Tax Code of Ukraine defines two main taxation systems – general and simplified.

Characteristic features of the general system.

- Type of business entity.Legal entities, individual entrepreneurs (FOP), separate divisions can apply.

- Salaried workers. The number of employees is unlimited.

- Activities. The list of permitted KVEDs is unlimited.

- Income limit. Legislation does not set limits.

- Taxation. Mandatory taxes for the general system:

Income tax of 18%, which is determined by the formula: profit = income minus expenses;

value added tax (VAT) 20%mandatory if the income exceeds one million hryvnias.

Taxes for salaried employees: 22% of VAT on their income (paid at the employer’s expense), 18% of personal income tax and 1.5% of personal income tax (withheld from the employee).

Depending on the specifics of the activity, some business entities also pay land tax, real estate tax, excise tax, and others.

- Reporting and accounting. Accounting and HR records are mandatory. Therefore, all enterprises on the general system must report by submitting an income tax declaration and a financial report. At the same time, entrepreneurs submit a Declaration on property status and income. When there are payments to individuals, they must be reflected in a special Combined Statement, and VAT payers also submit a VAT Declaration.

Characteristic features of a simplified system.

- Type of business entity.The simplified system is available for legal entities and sole proprietorships and is divided into four tax groups:

And the group suitable for those FOPs who plan to provide household services to the population or sell in the markets.

II group the sale of goods and the provision of services is allowed, but only to the simplified or the population.

III group is also available for legal entities and allows to provide services to taxpayers on the general taxation system.

IV group is intended only for producers of agricultural products.

- Salaried workers. There are restrictions for certain groups. In particular, it is forbidden to hire employees for Group I of the single tax, and no more than 10 people for Group II.

- Activities. There are a number of prohibited activities, for example, the production and sale of jewelry, bookmaker business, currency exchange, financial mediation, trade in motor vehicles and much more. The full list can be found in Article 291.5 of the Code of Criminal Procedure.

- Income limit. Limits are set for each group. In particular, for the I group, the monetary turnover cannot exceed 167 MZP sizes, for the II group – 834 MZP sizes, for the III – 1167 MZP sizes, which in 2024 amounts to UAH 8,285,700.

- Taxation. A fixed rate of a single tax on income (turnover) is provided for the reporting period for entrepreneurs of the I and II tax groups, and for the III group – 5% of the turnover or 3% for VAT payers. In addition, entrepreneurs pay 22% of the MSP for themselves, and if there are employees, then the taxes are the same as in the general system.

- Reporting and accounting. There are no exceptions to the obligation to keep records, but it is allowed to do it in a simplified manner. The main reporting for everyone is the Single Tax Declaration, in addition, companies submit annual financial statements. Also, simplified applicants, if necessary, hand in the Combined Reporting and VAT Declaration.

In Ukraine, NGOs (non-governmental organizations) that act in accordance with their statutory goals and do not aim to make a profit are also distinguished. Can NGOs be on the general or simplified taxation system? In 99% of cases – no. However, there are situations when NGOs are VAT payers. But they are allowed to be on the simplified taxation system only under the condition of exclusion from Register of non-profit organizations.

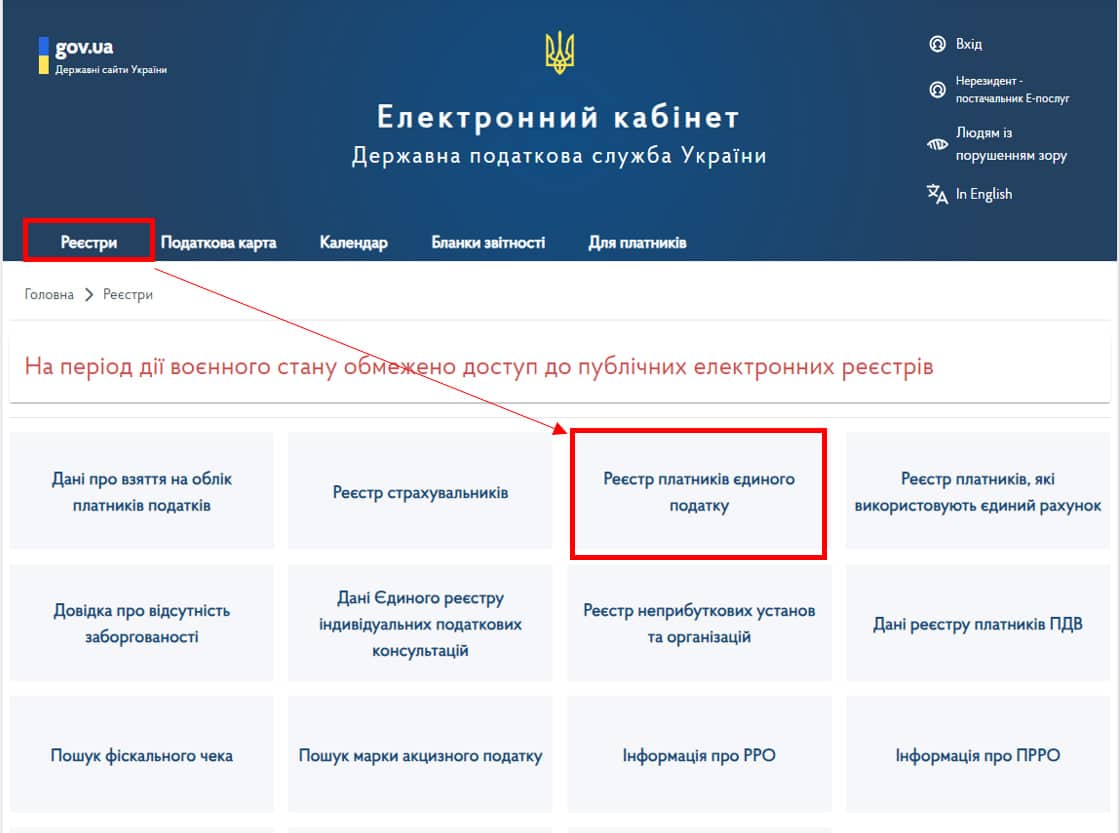

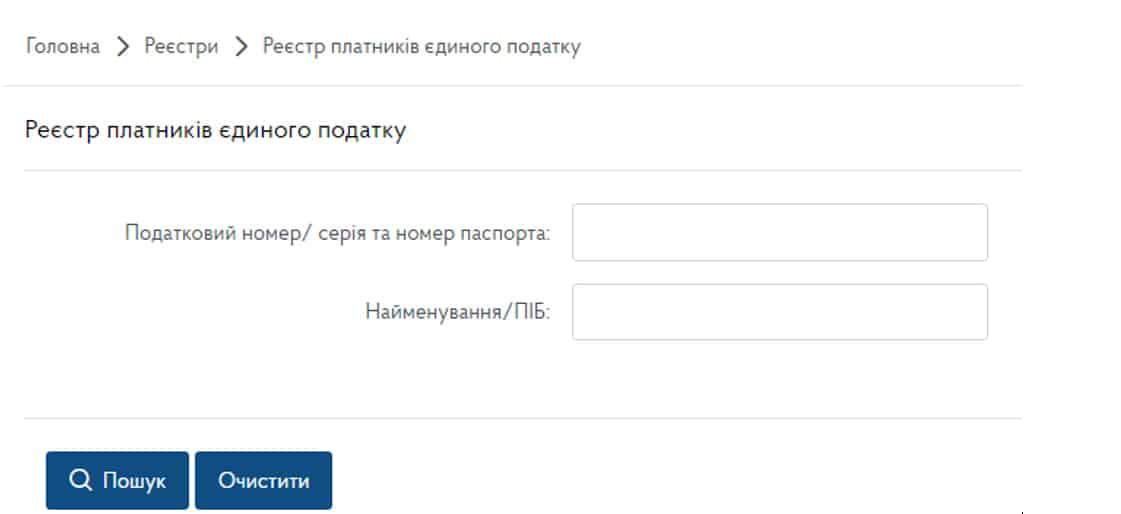

Entrepreneurs can always check which tax system they are on. Just use the services Electronic account of the payer. You need to go to the Registers section – Register of single tax payers

and enter the number or name of the payer.

If there is no data in this registry, it means that you are on a shared system.

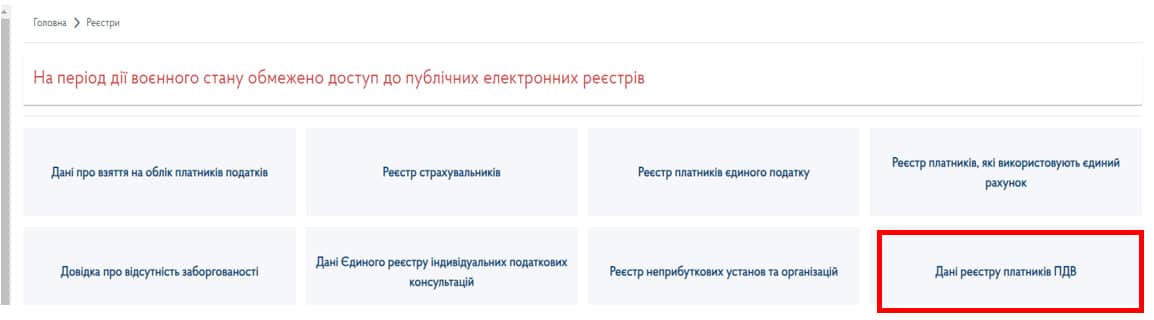

And the status of the VAT payer can be seen in the section Data from the register of VAT payers.

We will consider the criteria for selecting the optimal taxation system on the example of a ready-made case

We received an inquiry from a client who wanted to open his business, but did not understand which tax system would suit him. He planned to provide digital marketing services, involving bloggers and other service providers, both legal entities and individuals. He expected that in the first two months the income would be within 400,000 hryvnias, and in the future – approximately 700,000 hryvnias. in a month or more. At the same time, planned expenses were to make up 80% of income, and the number of employees was to be up to 6 people. The client wanted to transfer accounting and reporting to an outsourcing company.

We share with you the main criteria that our specialists focused on in order to provide the client with reasoned recommendations regarding the choice of a taxation system for his business.

Activities.For digital marketing, there are no restrictions on both the simplified and general taxation systems. When choosing any other types of activities, we analyze whether they are not included in the list of those prohibited for the simplified system.

Main counterparties.For this case, a simplified system with a single tax rate of 5% or a general system is suitable. And if the majority of counterparties are VAT payers, then in order not to overpay, it is better to get such a status as well.

Expected volume of turnover.In general, for the first year of activity, the level of income is sufficient to work on a simplified taxation system. But when it exceeds 1167 MZP, it will be necessary to switch to the general system.

Expected level of expenses.We present a comparative calculation that will show which tax system is more profitable to choose in this case.

In our example:

| General system of taxation | Simplified tax system |

| Revenue without VAT from sales = UAH 7,800,000.

Expenses = UAH 6,240,000. We will calculate the amount of income tax – (7800000-6240000) *18% = 280800 UAH.

On the general system, the client will have to pay UAH 280,800. income tax. |

Revenue without VAT from sales = UAH 7,800,000.

Expenses = UAH 6,240,000. Let’s calculate the amount of the single tax – 7,800,000 * 5% = 390,000 UAH.

On the simplified system, at a rate of 5%, the client will have to pay UAH 390,000. single tax. |

As you can see, the tax will be lower on the general taxation system.

Number of employees.There are no prohibitions for Group III and the general system.

Accounting.In this situation, it is necessary to conduct comprehensive accounting of various processes of the company’s work and report regularly. Therefore, it is really better to delegate this work to outsourcing specialists in order to focus on the development of your business and save time and money. For example, in our company accounting a similar enterprise providing digital marketing services will cost approximately UAH 100,000 per year under the simplified tax system. It will cost companies on the general system approximately UAH 300,000/year.

As you can see, there is no universal answer or single approach in choosing a taxation system. Complex analysis, well-founded arguments and recommendations of qualified specialists are what will help to reach the best result, but the final decision is still made by the business owner. After all, only he has the best understanding of the financial needs and strategies of the business, as well as the greatest interest in obtaining the maximum profit. And if you still have questions or need advice on choosing the optimal taxation system, contact us.

Victoria Novodvorska Linkedin